It is widely known that technology is an essential part of every business today, and the use of e-Tax Invoices and e-Receipts is another aspect that every business should adopt. Let’s look at how to prepare before using e-Tax Invoices and e-Receipts:

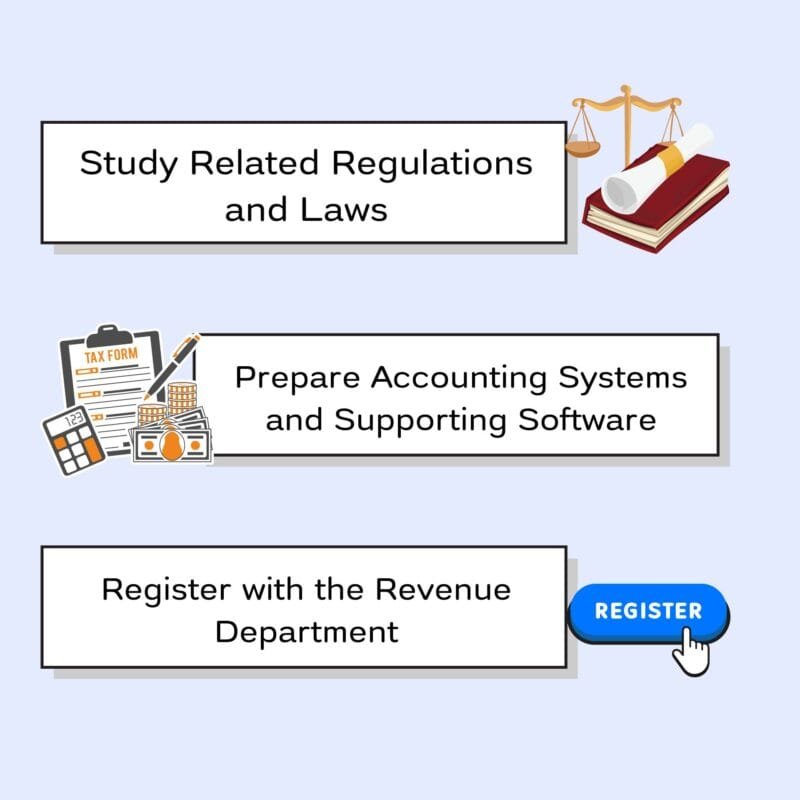

1. Study Related Regulations and Laws

Start by understanding the laws and regulations of the Revenue Department related to e-Tax Invoices and e-Receipts. You can research this information on the Revenue Department’s website or attend seminars on this system to get comprehensive information.

2. Prepare Accounting Systems and Supporting Software

Check if your accounting system or software supports issuing e-Tax Invoices & e-Receipts. If not, you may need to upgrade your software or choose a service provider that supports e-Tax Invoices & e-Receipts.

3. Register with the Revenue Department

You need to register with the Revenue Department to use e-Tax Invoices & e-Receipts, which can be done online via the Revenue Department’s website. Important documents such as a company certification and relevant licenses must be prepared.

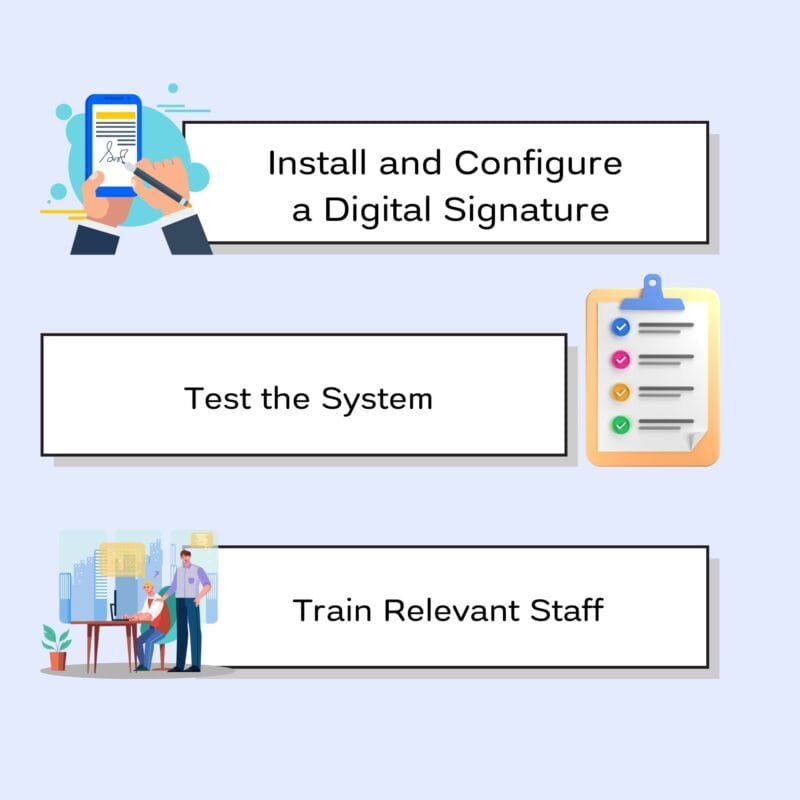

4. Install and Configure a Digital Signature

– Using e-Tax Invoices & e-Receipts requires a digital signature to certify the authenticity of the documents. You will need to set up a program for creating a digital signature and obtain a certificate from an authorized service provider.

5. Test the System

– Before actual implementation, test issuing e-Tax Invoices and e-Receipts by sending documents to customers and receiving them back through the system to verify the accuracy of the information.

6. Train Relevant Staff

– Staff responsible for issuing tax invoices or receipts should undergo training on the e-Tax Invoice & e-Receipt system to ensure they understand the processes and can use the system correctly.

7. Prepare Communication with Customers

– Inform customers that your company will switch to e-Tax Invoices & e-Receipts so they are aware and can accept electronic documents.

8. Backup Data and Ensure Security

– Set up a system for data backup and document security for e-Tax Invoices & e-Receipts to prevent data loss or damage.

9. Check Internet and Network Readiness

– Using e-Tax Invoices & e-Receipts requires a stable internet connection and a network system that can support continuous usage.

With these preparations in mind, let’s start using e-Tax Invoices & e-Receipts!

Source: ditc.co.th

If you want your business to reach online customers and achieve sustainable marketing results, we are happy to provide consultation on what you need.

For further inquiries, contact us at:

Tel. 093 696 4498 Line OA: https://lin.ee/po8XduU

Website: www.pkindev.com E-mail: mongkontep@pkindev.com

Phuket Innovative Development Co., Ltd. has received numerous awards for its achievements.

INNOVATIVE MAKE THINGS BETTER